How AEPS Registration Process Makes Ezulix Portal Safe and Secure

When we talk about digital transaction, first thing which comes in our mind is security. Security plays vital role in businesses which include online transaction attribute. AEPS business is most popular for cardless and PIN-less banking in India over the last few years. A big part of population is using AEPS, to banking services not only in rural but also in urban areas.

If we are talking about AEPS service, and we don’t talk about Ezulix Software then it may be disrespectful somehow. Well known best AEPS service provider company in India over the 2015, has more than 500+ live portal and 10M+ active members all over India.

But today here we will discuss that why Ezulix AEPS portal is so safe and secure and which practices can other companies adopt from Ezulix.

So without wasting time, I come to the point.

To understand the security features of Ezulix AEPS portal, first we have to understand about AEPS registration process. Because, this is the starting point from where problem can be start. To keep this in mind, Ezulix put all efforts here to make sure they are adding with genuine members.

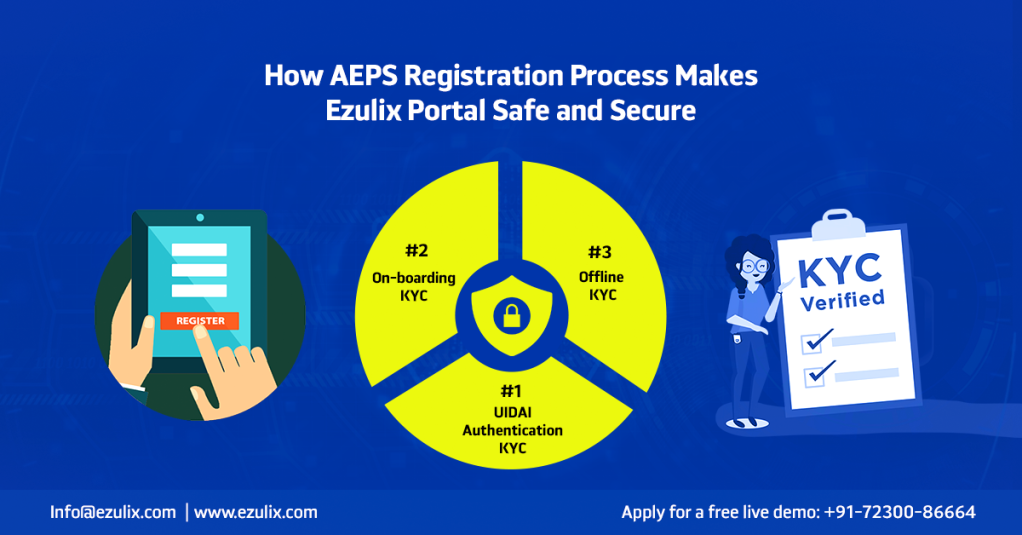

Here are the 3 high secure gates which a new member has to cross to start AEPS business with Ezulix portal which are following.

UIDAI Authentication KYC – First Step of AEPS Registration

In this first step, new member has to go through OTP based KYC or UIDAI authentication KYC. To start AEPS service with any company which integrated with Ezulix, he has to go through sign up process. After getting ID and password, when he goes to use AEPS service, he has to do OTP based KYC.

- Here agent has to fill Aadhaar card number and submit

- An OTP comes to registered number linked with Aadhaar card

- After submitting OTP, original Aadhaar card details comes on screen

So this is OTP based process which ensure this Aadhaar card details is genuine or not. These details directly forward to company where it saved in database.

Offline KYC – Secone Step of AEPS Registration

In this step, agent has to submit their original details like-

- Name

- Mobile Number

- Original Address

- Aadhaar Card (Scan Copy)

- PAN Card (Scan Copy)

Agent has to upload all original documents scan copy with all necessary details. All the details carry forward to admin, where he review all documents and approve to use AEPS service.

On-boarding KYC – LAST Step of AEPS Registration

This is the last steps which you have to follow as agents to start AEPS service.

In this on-boarding KYC, you just have to submit your name, number, address, 14 digital unique identity numbers with PAN card number.

After submitting all the details, now you are ready to use AEPS service through Ezulix AEPS software.

So these are 3 high secured Gateway, through which an agent has to go to use AEPS service through Ezulix.

I hope you have understood why Ezulix AEPS panel is so safe and secure for cashless transaction. This is the reason today, Ezulix is not just a name in AEPS industry, it is a BRAND which creates solutions that no one can challenge.

Conclusion

So here we discussed why Ezulix AEPS panel is so safe and secure.

Here is lots of things which other companies can follow like how they can make their panel as secure as Ezulix. Along with security, Ezulix support system makes a different in Industry. Their support team is always in standby mode to help agents and to solve their issues. Along with this, they recently started ticket system to resolve problems in a systematic way, where agents has to submit their problem in the form of ticket and they get solution ASAP as ticket response.

So If you are planning to start your own Aadhaar ATM and looking for best AEPS service provider, who offer best AEPS solution with high security, best support and good commission then Ezulix can be a good option now a days.